Loading

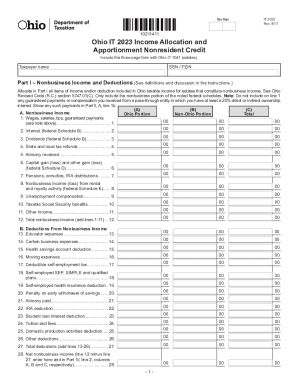

Get Ohio It 2023 Income Allocation And Apportionment Nonresident Credit

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ohio IT 2023 Income Allocation and Apportionment Nonresident Credit online

Filling out the Ohio IT 2023 Income Allocation and Apportionment Nonresident Credit may seem complex, but this guide is designed to simplify the process. Follow these clear steps to ensure all necessary information is accurately completed.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your taxpayer name and Social Security number (SSN) or Federal Employer Identification Number (FEIN) at the top of the form. Ensure this information is accurate, as it is crucial for processing your credit.

- In Part I, focus on nonbusiness income and deductions. Fill in each applicable section, including wages, interest, dividends, and other income sources, allocating them between Ohio and non-Ohio portions using the correct columns.

- Continue in Part I by entering deductions from nonbusiness income. List deductible expenses such as educator expenses and health savings account deductions, ensuring to accurately reflect any amounts applicable for each category.

- Calculate your total nonbusiness income by adding the totals from the previous lines. This total will be carried forward to Part IV; ensure all total calculations are precise.

- In Part II, report business income, ensuring you separate business income before deductions. Fill out information related to self-employment income and any guaranteed payments from pass-through entities.

- Document deductions from business income in Part II by listing all applicable adjustments. This section may include depreciation adjustments and other deductible expenses.

- In Part III, apply the apportionment formula for business income. Carefully follow the instructions to calculate the Ohio apportionment ratio based on property, payroll, and sales.

- In Part IV, summarize all business and nonbusiness income. Ensure you correctly input the values obtained from previous sections, including adjustments to arrive at a final total.

- Before concluding, review every entry for accuracy. Once confirmed, you can save changes, download, and print the form for submission.

Complete the Ohio IT 2023 Income Allocation and Apportionment Nonresident Credit online today for a smoother filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.