Loading

Get Ky Form 2210-k 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY Form 2210-K online

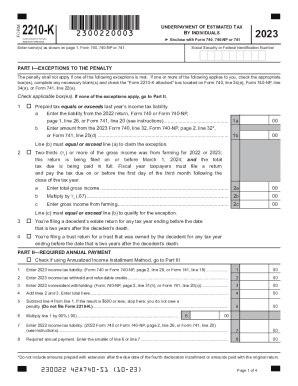

Filling out the KY Form 2210-K online is an essential step for individuals to determine if they owe an underpayment of estimated tax penalty. This guide provides clear, step-by-step instructions tailored to users of all skill levels to ensure a smooth completion process.

Follow the steps to fill out the KY Form 2210-K online

- Press the ‘Get Form’ button to access the KY Form 2210-K and open it for online editing.

- Enter your name(s) as shown on page 1 of Form 740, 740-NP, or 741 in the designated field. Make sure the information matches exactly.

- In Part I, review the exceptions to the penalty. If any apply to you, check the appropriate box(es) and provide additional information as required.

- For exceptions related to prepaid taxes, ensure you complete lines 1a and 1b to demonstrate that your prepaid tax meets the necessary criteria.

- Move to Part II to calculate your required annual payment. Fill in lines 1 through 8 based on your 2023 income tax liability and any withholding or refundable credits.

- If you are using the Annualized Income Installment Method, indicate this by checking the appropriate box and continue to Part III.

- In Part III, enter your adjusted gross income for the various periods as required and calculate the annualized income.

- Once all sections are complete, save your changes. You can then choose to download, print, or share your completed form.

Complete your KY Form 2210-K online today for a hassle-free filing experience.

1. Late Filing Penalty: The penalty is 2% of the total taxes owed for every 30 days or fraction of that time that a return is filed after the tax return deadline. The maximum penalty is 20% of the taxes owed amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.