Loading

Get Ky Dor 4972-k 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY DoR 4972-K online

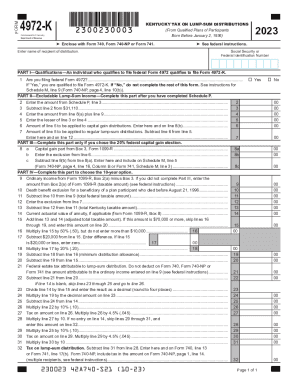

The KY DoR 4972-K form is essential for individuals who receive lump-sum distributions from qualified plans and wish to ensure proper tax reporting in Kentucky. This guide provides clear, step-by-step instructions to help users fill out the form accurately and efficiently online.

Follow the steps to successfully complete the KY DoR 4972-K form.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by entering the recipient's name in the designated space at the top of the form. Ensure that the name matches the one on the official identification documents.

- Provide the Social Security or Federal Identification Number of the recipient, as this is necessary for tax purposes.

- In Part I, indicate whether you are filing federal Form 4972. If the answer is 'Yes', you qualify to file Form 4972-K. If 'No', do not continue with the form.

- For Part II, first complete Schedule P and enter the amount from Schedule P, line 3 in the corresponding field.

- Subtract line 2 from $31,110 and enter the result in the next field. This calculation will assist in determining the excludable lump-sum income.

- Combine the values from line 8(a) and line 9, and enter this total in the appropriate section.

- Identify the lesser of line 3 or line 4 and record it accordingly to ensure correct calculations for tax reporting.

- Complete the subsequent fields in Part II and then proceed to Part III if you have elected the 20% federal capital gain option.

- For Part IV, enter the ordinary income from Form 1099-R, ensuring that you follow the guideline for amounts specified in Box 2(a) and Box 3.

- Continue filling out the remaining lines in Part IV, performing necessary calculations as instructed. Ensure all entries are accurate and adhere to relevant forms.

- Once all information is complete, users can save changes, download the document for personal records, print it, or share it as needed.

Complete your KY DoR 4972-K form online today to ensure accurate and timely tax reporting.

Individual Income Tax is due on all income earned by Kentucky residents and all income earned by nonresidents from Kentucky sources. Kentucky's individual income tax law is based on the Internal Revenue Code in effect as of December 31, 2021.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.