Loading

Get Ca Fppc Form 803 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FPPC Form 803 online

This guide provides a clear and comprehensive overview of how to fill out the CA FPPC Form 803 online. By following the steps outlined, users can ensure they correctly disclose payments made at their behest for legislative, governmental, or charitable purposes.

Follow the steps to accurately complete the form online.

- Click the ‘Get Form’ button to obtain the form and access it in your preferred editor.

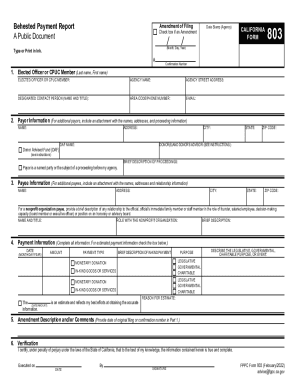

- In the Identification section, enter the name of the elected officer or CPUC member, including their last name and first name. Provide the agency name, agency street address, designated contact person's name and title, and their phone number and email address.

- For the Payor Information section, enter the name and address of the person making the payment. If the payment comes from a Donor Advised Fund, check the corresponding box and include the DAF name and the donor's advisor details.

- In the Payee Information section, identify the person or organization receiving the payment. If the payee is a nonprofit organization, include the relationship details for any official involved.

- Complete the Payment Information section by entering the payment date and amount. Select the payment type and provide a brief description of the purpose or event associated with the payment.

- If filing estimated payment information, check the estimate box, assert that the estimate reflects your best efforts, and explain why accurate information is not available.

- If amending a previously filed form, use part 5 to describe the amendment and include the date of the original filing or confirmation number.

- Finally, verify the information by signing and dating the form under penalty of perjury, ensuring all sections are complete before submission.

Complete your CA FPPC Form 803 online to ensure compliance with reporting regulations.

Behested Payments Generally, a payment is considered "behested" and subject to reporting if it is made: At the request, suggestion, or solicitation of, or made in cooperation, consultation, coordination or concert with the public official; and. For a legislative, governmental or charitable purpose.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.