Loading

Get Or Form Or-ef 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR Form OR-EF online

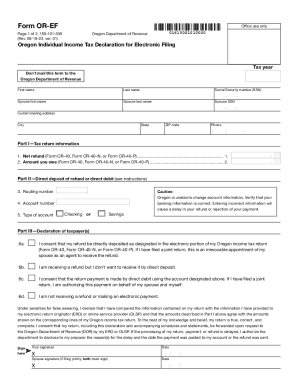

This guide provides clear and supportive instructions on how to fill out the OR Form OR-EF online. By following these steps, users can accurately complete their Oregon Individual Income Tax Declaration for Electronic Filing.

Follow the steps to fill out the OR Form OR-EF online

- Press the ‘Get Form’ button to obtain the OR Form OR-EF and open it in your preferred online editor.

- Fill in the tax year for which you are filing the declaration. Ensure that this matches the year of your tax return.

- Enter your first name, last name, and Social Security number (SSN) in the designated fields.

- If applicable, provide your spouse’s first name, last name, and SSN.

- Provide your current mailing address, including city, state, and ZIP code, in the respective sections.

- Input your phone number, ensuring to include area code.

- Part I: Fill in your net refund amount and the amount you owe as indicated on Forms OR-40, OR-40-N, or OR-40-P.

- Part II: For direct deposit or debit, include your bank’s routing number and your account number. Select whether it is a checking or savings account.

- Part III: Review and select the appropriate declaration options based on your refund preferences and electronic payment consent.

- Sign and date the form; if you are filing jointly, include your spouse's signature and date.

- Part IV: If applicable, have your electronic return originator or paid preparer complete their declaration, including their signature and date.

- Once you have completed the form, save the changes, and download or print the document as needed.

Complete your OR Form OR-EF online today for a smooth filing experience.

Use Form 4506, Request for Copy of Tax Return, to request copies of tax returns. Automated transcript request. You can quickly request transcripts by using our automated self-help service tools. Please visit us at IRS.gov and click on “Get a Tax Transcript...” under “Tools” or call 1-800-908-9946.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.