Loading

Get File And Pay Form Ct1040 Electronically Using Myconnect At Portal

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the File And Pay Form CT1040 Electronically Using MyconneCT At Portal online

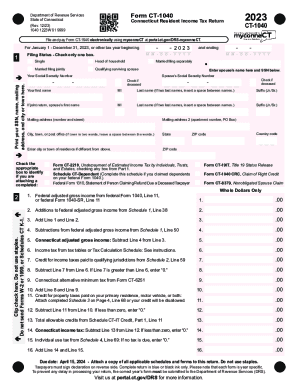

This guide provides step-by-step instructions for filling out the File And Pay Form CT1040 electronically, ensuring a smooth and efficient online filing experience. Whether you are familiar with tax documents or new to the process, this guide will support you in completing your form accurately and effectively.

Follow the steps to complete your Form CT1040 online.

- Click ‘Get Form’ button to access the form and open it in the editor for your completion.

- In the form, begin by entering your social security number, name, mailing address, and city or town into the designated fields. Ensure all information is accurate and reflects your current residence.

- Select your filing status by checking only one box corresponding to your situation: Single, Head of Household, Married Filing Jointly, Qualifying Surviving Spouse, or Married Filing Separately. For married filing separately, include your spouse's name and social security number.

- Provide your federal adjusted gross income from your federal Form 1040 in the designated area. Proceed to list any additions to your income that apply, as reflected in Schedule 1.

- Next, enter the total subtractions from your income according to Schedule 1. This will give you your Connecticut adjusted gross income.

- Calculate your income tax using the applicable tax tables or Tax Calculation Schedule, and enter the amount in the designated field.

- If you have any credits for income taxes paid to qualifying jurisdictions, record them from Schedule 2. Subtract this amount from your total income tax.

- Continue filling out sections for allowable credits and any payments made, including withholding amounts from Forms W-2 or 1099.

- Review the form for any overpayments or taxes due, and calculate your refund or total amount due based on prior entries.

- In the final section, you will need to sign and date the form, ensuring to include your daytime phone number and email address if applicable.

- After completing all sections, save your changes and review the document before submitting. Options to download, print, or share the form will be available.

Complete your Form CT1040 online today for a hassle-free filing experience.

Electronic Filing Mandate – Return preparers who prepared 50 or more Connecticut income tax returns must file returns electronically. E-File Registration Requirements – Acceptance in the Connecticut e-file program is automatic with acceptance in the federal e-file program.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.