Loading

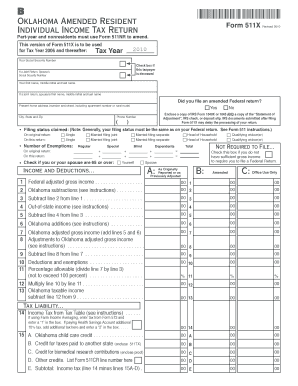

Get This Version Of Form 511x Is To Be Used For Tax Year 2006 And Thereafter Tax - Tax Ok

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the This Version Of Form 511X Is To Be Used For Tax Year 2006 And Thereafter Tax - Tax Ok online

This guide provides step-by-step instructions for completing the This Version Of Form 511X Is To Be Used For Tax Year 2006 And Thereafter Tax - Tax Ok online. By following these instructions, users will be able to accurately fill out the form and submit it efficiently.

Follow the steps to complete your tax form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the document editor.

- Begin by entering your Social Security Number in the designated field. Make sure to check the box if the taxpayer is deceased.

- If filing a joint return, enter your spouse’s Social Security Number and their full name in the respective fields.

- Indicate if you filed an amended Federal return by checking 'Yes' or 'No'. If ‘Yes’, remember to enclose the copy of IRS Form 1040X or 1045 along with the necessary supporting documents.

- Fill in your current address, including street number and name, city, state, and zip code.

- Input your phone number for contact purposes.

- Select your filing status from the options provided. Ensure your filing status aligns with your original Federal return.

- Enter the number of exemptions you are claiming, and check the box if you or your spouse is 65 or older.

- Proceed to the income and deductions section. Input your Federal adjusted gross income and complete lines 1 through 14, following the detailed instructions provided in the guide.

- Ensure to include supporting documents for any adjustments you declare, including those for out-of-state income, subtractions, or additions to your income.

- Review the Tax Liability section carefully to determine your tax credits, deductions, and total amount due or refund, using calculations as outlined.

- Once all sections are completed, ensure that your return is signed and dated by both you and your spouse (if applicable).

- Finally, save your changes, download the completed form, and prepare to print or share it as needed.

Start filling out your documents online to ensure accuracy and compliance.

The Internal Revenue Service limits the amount of time you have to file a 1040-X to the later of three years from the date you file the original tax return, or two years from the time you pay the tax for that year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.