Loading

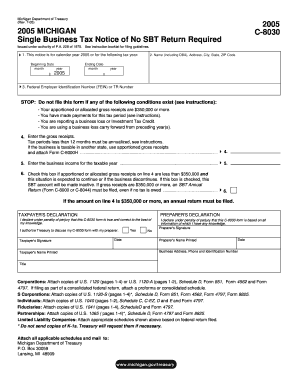

Get 7-05) 2005 Michigan Single Business Tax Notice Of No Sbt Return Required Issued Under Authority Of

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 7-05) 2005 MICHIGAN Single Business Tax Notice Of No SBT Return Required Issued Under Authority Of online

Filling out the 2005 Michigan Single Business Tax Notice of No SBT Return Required is a straightforward process. This guide will help you understand each section of the form and ensure that you provide all necessary information accurately and efficiently.

Follow the steps to complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify the tax year relevant to your business activity. Enter the beginning and ending dates, including the month and year, for the calendar year 2005. Make sure to enter these dates in the correct format.

- Provide your business name, including any doing business as (DBA) names, along with the complete address, city, state, and ZIP code.

- Fill in your Federal Employer Identification Number (FEIN) or the Michigan Treasury (TR) number, making sure to use the same number on any attached documents.

- Calculate and enter your gross receipts. If your business operated for less than 12 months, remember to annualize your gross receipts by multiplying by 12 and dividing by the number of months you were active. Note this annualization above the amount entered.

- Enter your business income for the taxable year, using the appropriate worksheets to help with your calculations.

- If your apportioned or allocated gross receipts are less than $350,000 and expected to continue, check the provided box. This will make your SBT account inactive.

- Sign and date the form as the taxpayer. If someone else prepared the form, they must also sign and date it.

- Attach any necessary schedules based on your business entity type and ensure all required documentation is included before submission.

- Mail the completed form and all attached documents to the Michigan Department of Treasury at the provided address, or save changes and download/print for your records.

Complete your filing by competing documents online to ensure a smooth experience.

Filing Thresholds Taxpayers with less than $350,000 in allocated or apportioned gross receipts are not required to file a return or pay the tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.