Loading

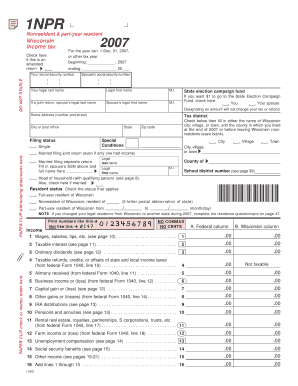

Get Print Clear 1npr Wisconsin Income Tax Check Here If This Is An Amended Return Do Not Staple

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Print Clear 1NPR Wisconsin Income Tax Check Here If This Is An Amended Return DO NOT STAPLE online

Filing your Wisconsin income tax can be straightforward with the correct guidance. This document provides a step-by-step guide on how to complete the Print Clear 1NPR form online, ensuring you understand each section and can submit your return confidently.

Follow the steps to complete your tax form efficiently.

- Click ‘Get Form’ button to access the Print Clear 1NPR form. This will allow you to obtain the document and open it for editing.

- Begin by filling in the year for which you are filing your tax return at the top of the form. Make sure to check the box if this is an amended return.

- Enter your social security number and your spouse's social security number if applicable, along with your legal names and any applicable campaign fund designations.

- Provide your home address, city, and zip code. Check the box for your filing status, including options such as single, married filing jointly, married filing separately, head of household, and more.

- Indicate your resident status. Choose from full-year resident, nonresident, or part-year resident. Provide details on your residence if necessary.

- Complete the income section by entering the amounts in the prescribed boxes for each category of income. Make sure not to use commas or cents.

- Proceed to fill out adjustments to income. Refer to the specific adjustments that apply and input the relevant amounts.

- Calculate your adjusted gross income based on the figures from previous sections.

- Continue through the tax computation, managing the calculations for exemptions and deductions as outlined in the form.

- Finally, review the refund or amount owed section, and specify how much you want refunded or applied to estimated taxes.

- Once all information is completed, save your changes, and you can download, print, or share the form as needed.

Begin filling out your Wisconsin income tax form online today for a hassle-free filing experience.

Every corporation organized under the laws of Wisconsin or licensed to do business in Wisconsin (except certain organizations exempt under secs. 71.26(1) or 71.45(1), Wis. Stats.) is required to file a Wisconsin corporate franchise or income tax return, regardless of whether or not business was transacted.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.