Loading

Get Mo Form Mo-62(ef) 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO Form MO-62(ef) online

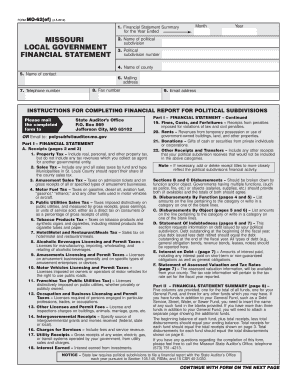

The MO Form MO-62(ef) is a crucial financial statement used by political subdivisions in Missouri to report financial activities for the year. This guide provides step-by-step instructions to assist users in completing the form online accurately and efficiently.

Follow the steps to complete the MO Form MO-62(ef) online:

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin filling out the Financial Statement Summary, starting with the month and year for the report.

- Enter the name of the political subdivision, including the political subdivision number and the name of the county.

- Provide the contact name, telephone number, mailing address, fax number, and email address in the designated fields.

- Proceed to Part I and report receipts: outline the types of taxes, fees, and other revenues in the appropriate sections.

- Continue with disbursements: categorize and list expenditures by function and object as required in Parts B and C.

- Complete the Statement of Indebtedness, detailing outstanding debts at the beginning and end of the fiscal year.

- Fill out the Statement of Assessed Valuation and Tax Rates with the relevant valuation figures and tax rates.

- Move to Part II to summarize financial statements, indicating beginning balances, total receipts, disbursements, and ending balances.

- Once all fields are completed, utilize options to save changes, download, print, or share the form for submission.

Complete the MO Form MO-62(ef) online now to ensure timely and accurate financial reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Missouri state taxes are calculated based on your taxable income and applicable tax brackets. The state uses a graduated tax rate system, meaning higher income levels are taxed at higher rates. To assist you in computing your tax obligations, the MO Form MO-62(ef) provides details on the rates and calculation process. Understanding these parameters will help you prepare for your tax filings.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.