Loading

Get Local Intangibles Tax Return Form 200 Rev. 7-06 - Ksrevenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Local Intangibles Tax Return Form 200 Rev. 7-06 - Ksrevenue online

Filling out the Local Intangibles Tax Return Form 200 Rev. 7-06 can seem daunting, but with clear guidance, you can complete it efficiently. This guide offers a step-by-step approach to help you navigate each section of the form while filing online.

Follow the steps to accurately complete the form.

- Click ‘Get Form’ button to download the Local Intangibles Tax Return Form 200 Rev. 7-06 and open it in your preferred document editor.

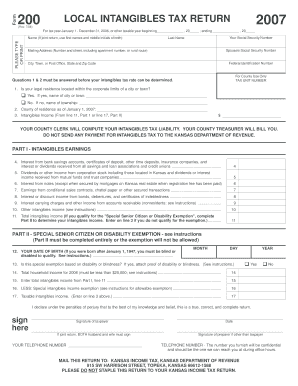

- Fill out the header section with your name, mailing address, and Social Security number. If applicable, include your spouse’s details using their first names and middle initials.

- Answer the first two questions regarding your legal residence and the county of residence. These answers are necessary to establish your intangibles tax rate.

- Report your intangibles income in Part I. Carefully itemize your earnings from various sources such as bank accounts, dividends, and bonds as indicated on lines 4 through 10.

- Calculate your total intangibles income by adding the amounts from lines 4 through 10. Enter this total on line 11.

- If eligible, fill out Part II for the special senior citizen or disability exemption. Ensure you provide all required information and documentation, particularly on lines 12 through 17.

- Sign and date the form. If this is a joint return, ensure both parties sign. If someone else prepared the form, include their signature and phone number.

- Review the completed form for accuracy to prevent delays or issues. Save your changes and proceed to download or print the form as needed.

- Mail the completed return to the Kansas Department of Revenue at the specified address. Do not send any payment with this form.

Complete your Local Intangibles Tax Return Form 200 online today!

The intangibles tax (not to be confused with the state income tax which is used to support state government) is a local tax levied on gross earnings received from intangible property such as: savings accounts. stocks. bonds. accounts receivables.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.