Loading

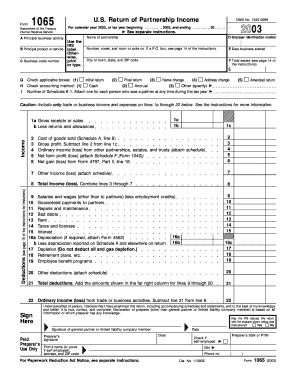

Get 2003 Form 1065. U.s. Partnership Return Of Income - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2003 Form 1065. U.S. Partnership Return Of Income - IRS online

This guide provides a comprehensive overview of how to complete the 2003 Form 1065, the U.S. Partnership Return of Income. Whether you are new to partnership tax forms or need a refresher, this step-by-step instruction will help you navigate each section effectively.

Follow the steps to successfully fill out your partnership return.

- Press the ‘Get Form’ button to access the form and open it for completion.

- Fill in the name of the partnership in the designated field, followed by the principal business activity and product or service.

- Enter the employer identification number (EIN) and the date the business started, ensuring that all information is accurate.

- Provide the business code number and total assets in the appropriate sections. Indicate any applicable checkboxes related to the return, such as 'initial return' or 'final return'.

- Complete the income section, starting with gross receipts or sales. Deduct returns and allowances to calculate gross profit.

- Report other income and expenses on the form. This includes ordinary income from other partnerships and net farm profits.

- List all deductions, including but not limited to salaries, wages, guaranteed payments, and other business-related expenses.

- Calculate total deductions and determine the ordinary income or loss by subtracting total deductions from total income.

- Continue by completing schedules as required. Make sure to attach Schedules K-1 for each partner.

- Sign the form in the designated area and provide the date. If applicable, include the preparer's information.

- Review the completed form for accuracy and completeness before submitting.

- Finally, save any changes, and download, print, or share the completed form as needed.

Get started on completing your 2003 Form 1065 online today!

An LLC will file one of the following returns, depending on the situation: Single-member LLCs: Form 1040 (Schedule C, E, or F) Multiple-member LLCs (Partnership): Form 1065.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.