Loading

Get Form 976 - Uncle Fed's Tax*board - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 976 - Uncle Fed's Tax*Board - Irs online

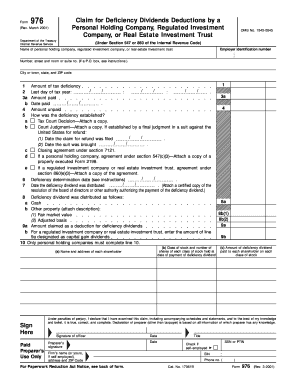

Filling out Form 976, designated for claiming deficiency dividend deductions, can seem daunting. This guide is designed to provide clear, step-by-step instructions for users, regardless of their prior experience with tax forms.

Follow the steps to successfully complete your Form 976 online.

- Click ‘Get Form’ button to obtain the form and open it in an editing interface.

- In the first section, provide the name of the personal holding company, regulated investment company, or real estate investment trust. This is essential for identifying the entity for which the claim is being made.

- Enter the employer identification number (EIN) associated with the entity. This number is crucial for processing the tax form correctly.

- Complete the address fields, including the number, street, and any room or suite number. If you are using a P.O. box for correspondence, ensure it is noted as per the instructions.

- Fill in the city or town, state, and ZIP code of the entity’s main office to ensure correct delivery of notices.

- Indicate the amount of tax deficiency and the last day of the tax year in the designated fields. Accurate figures here are critical for your claim.

- Describe how the deficiency was established in section 5, including attaching any necessary documents such as Tax Court decisions or court judgments.

- If applicable, include details for a closing agreement under section 7121 or other relevant agreement sections.

- Complete the distribution details of the deficiency dividend, including how it was distributed and any relevant fair market value or adjusted basis.

- In the final sections, provide the amount claimed as a deduction and details for any related shareholders. Make sure that all signatures are obtained from authorized officers.

- Review all entries for accuracy, then save your changes, download the completed form, or choose to print and file as necessary.

Complete your Form 976 online to ensure accurate filing and timely processing.

Claim for credit or refund. If the allowance of the deficiency dividend deduction results in an overpayment of tax, the taxpayer must file an amended income tax return in addition to Form 976 to obtain a credit or refund of the overpayment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.