Loading

Get Mn Fpp-16987

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN FPP-16987 online

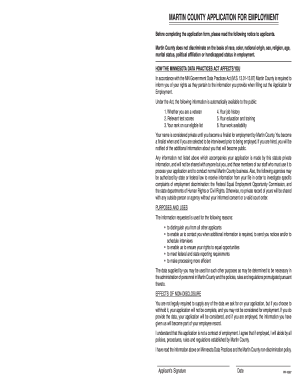

Filling out the MN FPP-16987 online can simplify your application process for employment with Martin County. This guide will walk you through each section of the form, ensuring that you provide the necessary information accurately and completely.

Follow the steps to complete your application effectively.

- Use the ‘Get Form’ button to access the MN FPP-16987 and open it in your preferred editor.

- Begin by entering the title of the position for which you are applying. Be specific and accurate regarding the role.

- Enter your full name, including last name, first name, and middle initial. Accuracy is crucial, as this will be used in all official documentation.

- Indicate your age by selecting 'Yes' or 'No' to confirm if you are between the ages of 18 and 70.

- Provide your present mailing address, including street, city, state, and zip code, along with your home and work phone numbers.

- Detail your employment history, starting with your most recent job. Include company name, telephone number, dates of employment, supervisor's name, reason for leaving, job title, and a description of your responsibilities.

- Complete the education section by listing all schools attended, course of study, years completed, whether you graduated, and any degrees or diplomas received.

- List any relevant licenses, registrations, or certificates, including issue dates and expiration dates.

- Answer any additional questions about special skills, language proficiency, driving license status, and ability to perform job functions with or without accommodations.

- If applicable, detail any military service and include additional training received during service.

- In the personal statement area, express your interest in the position and what you hope to achieve.

- Provide references who can speak to your qualifications. Be sure to note any that you do not wish to contact.

- Review all your entries for accuracy and completeness, ensuring that no fields are left blank unless explicitly stated as optional.

- After reviewing, you can save changes, download, print, or share the completed form as needed.

Complete your application online today to enhance your chances of employment with Martin County.

To get a MN sales tax ID number, you need to complete an application through the Minnesota Department of Revenue's website. This involves providing business details and ensuring all required documentation is in order. U.S. Legal Forms offers resources related to MN FPP-16987, making the entire process more manageable and efficient.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.