Loading

Get You Cannot Claim Exemption From Withholding If (a) Your

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the You Cannot Claim Exemption From Withholding If (a) Your online

Filling out the 'You Cannot Claim Exemption From Withholding If (a) Your' form online is essential for ensuring correct tax withholding by your employer. This guide provides detailed steps to help you navigate the process smoothly.

Follow the steps to complete the form effectively.

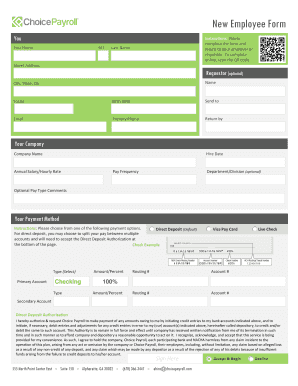

- Click ‘Get Form’ button to access the form and open it in your suitable online editor.

- Enter your first name, middle initial, and last name in the provided fields. Make sure to use your full legal name as it appears on government documents.

- Fill in your home address, including the street address, city, state, and ZIP code. Ensure all details are accurate to avoid processing delays.

- Provide your social security number for identification purposes. This number must be accurate and match your records.

- Select your marital status from the given options: Single, Married, or Married filing at a higher single rate. If married, but legally separated or your spouse is a nonresident alien, check the ‘Single’ box.

- Indicate the total number of allowances you are claiming based on the worksheets provided, following the applicable guidelines.

- If you are claiming an additional amount to be withheld from each paycheck, enter that amount in the designated field.

- If you meet the conditions for exemption, write ‘Exempt’ in the appropriate field, confirming that you had no tax liability last year and expect none this year.

- Review all information entered for accuracy. After confirming the details, sign and date the form to validate it.

- Once the form is complete, submit it to your employer using the preferred method indicated, such as email or online submission.

Complete the necessary forms online today to ensure accurate withholding from your paycheck.

For the 2022 income tax returns, the individual income tax rate for Michigan taxpayers is 4.25 percent, and the personal exemption is $5,000 for each taxpayer and dependent.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.