Loading

Get Nc Dor D-403 K-1 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC DoR D-403 K-1 online

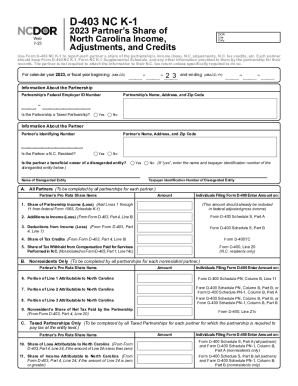

Filling out the NC DoR D-403 K-1 form is essential for reporting each partner’s share of the partnership’s income, adjustments, and credits in North Carolina. This guide will provide clear, step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete the form online.

- Press the ‘Get Form’ button to access the NC DoR D-403 K-1 form and open it in your editing tool.

- Enter the partnership's federal employer identification number. This is a unique identifier for the partnership and is essential for tax purposes.

- Indicate whether the partnership is a taxed partnership by selecting 'Yes' or 'No'. This is important for determining the tax treatment of the partnership.

- Provide the name, address, and zip code of the partnership. This information helps identify where the partnership is located.

- Fill in the partner's identifying number, ensuring accuracy to avoid any future issues.

- Specify if the partner is a North Carolina resident by selecting 'Yes' or 'No'. This affects the tax obligations of the partner.

- If applicable, answer whether the partner is a beneficial owner of a disregarded entity and enter the name and taxpayer identification number of that entity.

- Complete section A, entering the partner’s pro rata share items, including amounts for income, losses, additions and deductions to income, tax credits, and tax withheld, as necessary.

- If the partner is a nonresident, complete section B by providing corresponding amounts attributable to North Carolina.

- For taxed partnerships only, fill out section C if required, detailing any losses or income attributable to North Carolina.

- Once all sections are completed and reviewed for accuracy, users can save changes, download, print, or share the completed form as needed.

Complete your NC DoR D-403 K-1 form online today for hassle-free reporting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.