Loading

Get Nc Dor D-403 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC DoR D-403 online

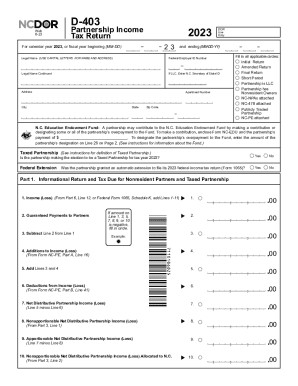

Filling out the NC DoR D-403 is an essential step for partnerships in North Carolina to report income and tax obligations accurately. This guide offers a comprehensive overview of each section and field within the form to assist you in completing it online with confidence.

Follow the steps to fill out the NC DoR D-403 accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the legal name of the partnership in capital letters in the designated fields. Provide the Federal Employer ID Number and complete the address, including apartment number, city, state, and zip code.

- Indicate the type of return by filling in the applicable circles: Initial Return, Amended Return, Final Return, and Short Period. Mark other applicable options such as Partnership is LLC or Partnership has Nonresident Owners.

- If applicable, fill in the amount of contribution to the N.C. Education Endowment Fund and indicate whether the partnership is making an election to be a Taxed Partnership for the tax year 2023.

- Complete Part 1 by providing information regarding income, losses, additions to income, deductions, and other relevant calculations as instructed on the form.

- Proceed to Part 2 if your partnership does not apportion income outside North Carolina; otherwise, complete the apportionment calculations as required.

- In Part 3, report nonapportionable net distributive partnership income or loss, including any explanations attached as needed.

- For Parts 4, 5, and 6, enter partner-specific information such as identifying numbers, shares of income, tax computations, and any deductions as appropriate.

- Review all entries thoroughly for accuracy. Once complete, save changes, download, or print the form as required, ensuring all partners receive the necessary information.

Complete your NC DoR D-403 online today to streamline your tax filing process.

The NCDOR officially began issuing 2022 Individual Income Tax refunds on Friday, March 10. Taxpayers may begin receiving refunds through the mail and direct deposit next week. Raleigh, N.C. The North Carolina Department of Revenue (NCDOR) officially began issuing 2022 Individual Income Tax refunds on Friday, March 10.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.