Loading

Get Short-year Or Fiscal-year Return Due Before Tax Forms ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Short-Year Or Fiscal-Year Return Due Before Tax Forms online

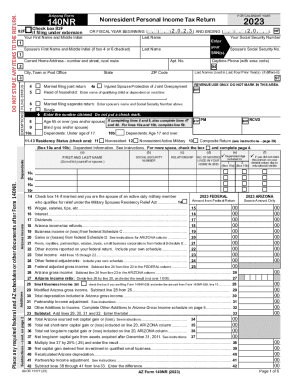

Filling out the Short-Year Or Fiscal-Year Return Due Before Tax Forms online can seem complex, but with a clear guide, it becomes manageable. This document provides detailed instructions on how to accurately complete each section and field in the form.

Follow the steps to successfully complete your tax form online.

- Click ‘Get Form’ button to obtain the tax form and open it in your preferred editor.

- Begin by entering your first name and middle initial, followed by your last name in the designated fields. Include your spouse's first name and last name if applicable.

- Fill in your current home address, providing your street number and name, city, state, and ZIP code accurately.

- Indicate your Social Security Number, and if married, include your spouse's Social Security Number.

- Select your filing status by checking the appropriate box for 'Married filing joint return', 'Married filing separate return', 'Single', or 'Head of household'. Provide any necessary child or dependent information.

- Complete the residency status section by selecting 'Nonresident' or 'Nonresident Active Military', ensuring to check any other relevant boxes.

- Provide all relevant income figures from your federal return, including wages, interest, dividends, and any other income sources as outlined in the form.

- Add any required subtractions and exemptions as specified throughout the document, ensuring all entries follow the guidelines.

- Double-check all entries for accuracy and clarity.

- Finally, save your changes, download the completed form, and choose to print or share as necessary.

Begin completing your Short-Year Or Fiscal-Year Return Due Before Tax Forms online today!

For a short tax year that (1) does not begin on the first day of a month and (2) does not end on the last day of a month, the tax year consists of the number of days in the year. Determine the year's midpoint by dividing the number of days in the tax year by two.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.