Loading

Get Ca Declaration Under Probate Code Section 13101 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Declaration Under Probate Code Section 13101 online

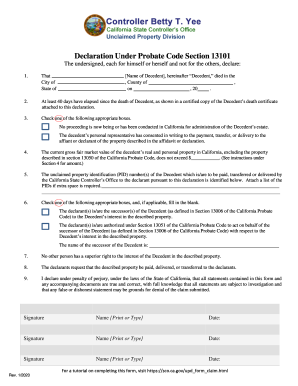

Filling out the CA Declaration Under Probate Code Section 13101 is an essential process for individuals seeking to collect unclaimed property of a decedent without the need for probate. This guide provides clear, step-by-step instructions to assist you in completing the form online, ensuring a smooth and efficient experience.

Follow the steps to successfully complete the declaration form online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering the name of the decedent, the county where they passed, and the date of death in the designated fields.

- In the next section, confirm that at least 40 days have passed since the decedent's death by attaching a certified copy of the decedent's death certificate.

- Select one of the provided options. Check the first box if no court proceedings have been initiated for the administration of the decedent’s estate. Alternatively, check the second box if there is written consent from the decedent's personal representative.

- Indicate the current gross fair market value of the decedent's real and personal property in California, ensuring it does not exceed the specified amount based on the decedent’s date of death.

- List the unclaimed property identification (PID) numbers for the decedent's property that is to be delivered, transferring, or paid, including additional sheets if necessary.

- Check the appropriate box regarding the relationship to the decedent and fill in the name of the person or trust entitled to the property.

- Confirm that no other individual has a superior right to the interest of the decedent in the properties listed.

- State your request for the described property to be paid, delivered, or transferred to you.

- Finish the form by declaring under penalty of perjury that all statements are true. Each claimant must print their name, sign, and date the form before submission.

Complete your CA Declaration Under Probate Code Section 13101 online today to expedite the process of claiming unclaimed property.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

13103. If the estate of the decedent includes any real property in this state, the affidavit or declaration shall be accompanied by an inventory and appraisal of the real property.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.