Loading

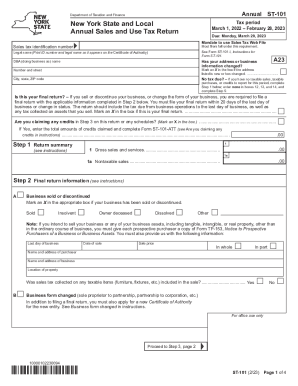

Get Form St-101 New York State And Local Annual Sales And Use Tax Return Revised 2/23

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form ST-101 New York State And Local Annual Sales And Use Tax Return Revised 2/23 online

Completing the Form ST-101 for New York State and Local Annual Sales and Use Tax Return is essential for accurate tax reporting. This guide provides a straightforward process that helps users navigate each section of the form online.

Follow the steps to effectively fill out the form online.

- Press the ‘Get Form’ button to access the form electronically.

- Enter your sales tax identification number as issued, ensuring it is accurate.

- Print your legal name as it appears on the Certificate of Authority and fill in the DBA (doing business as) name if applicable.

- Mark the box if your address or business information has changed or if this is your final return.

- In Step 1, provide a summary of your gross sales and any nontaxable sales, entering 'none' in boxes if there are no taxable sales or purchases.

- For Step 2, indicate if the business has been sold or discontinued, and provide necessary dates and sale information if yes.

- In Step 3, calculate the total sales and use taxes based on the information from your taxable sales and purchases.

- Continue to Step 4 to calculate any special taxes that may apply, ensuring accurate entries for each applicable category.

- Proceed to Step 5 to outline any other tax credits or advance payments you may have.

- In Step 6, finalize the calculation of taxes due by adding totals from previous steps and adjusting for any credits.

- Complete Step 7 if filing late to determine applicable penalties and interest.

- In Step 8, declare the total amount due and payment method for filing.

- Sign and date the form in Step 9, ensuring all required information is completed before submitting.

- Save your changes, download a copy for your records, and prepare to print or share the form as needed.

Start filling out your Form ST-101 online today to ensure timely and accurate tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Sales Tax - applies to retail sales of certain tangible personal property and services. Use Tax - applies if you buy tangible personal property and services outside the state and use it within New York State. Clothing and footwear under $110 are exempt from New York City and NY State Sales Tax.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.