Get Ny State Income Tax 2021-2024 Form - Fill Out And Sign ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY State Income Tax 2021-2024 Form - Fill Out And Sign online

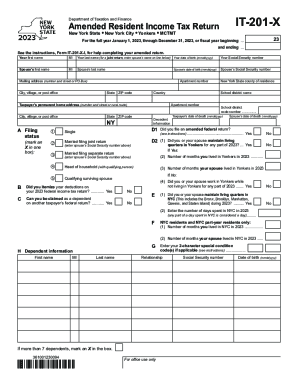

Filing your New York State Income Tax form can seem daunting, but with this comprehensive guide, you will find clear and supportive instructions to help you complete the NY State Income Tax 2021-2024 Form online with confidence. Whether you are amending your return or filing for the first time, this guide will assist you through each essential step.

Follow the steps to successfully complete your income tax form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in your personal information. Enter your first name, middle initial, and last name. If filing jointly, provide your partner's name in the designated fields. Include your date of birth and Social Security number accurately.

- Complete the mailing address section. Ensure you provide your apartment number (if applicable), street address, city or village, state, and ZIP code to ensure proper correspondence.

- Select your filing status by marking an X in the appropriate box. You can choose between options such as single, married filing jointly, married filing separately, head of household, or qualifying surviving spouse. Make sure to review your choice for accuracy.

- Fill out the section related to dependents, if applicable. List their names, relationships, and Social Security numbers. If you have more than seven dependents, indicate this by marking the relevant box.

- Proceed to provide information regarding your income. Fill in lines for wages, taxable interest, and additional income sources. Make sure to add each amount carefully and input the total adjusted gross income.

- Indicate whether you are claiming standard or itemized deductions. If you choose standard, refer to the standard deduction table to determine the correct amount.

- Complete the tax computation section. Calculate your taxable income and any applicable tax credits or surcharges related to New York City or Yonkers.

- Towards the end of the form, indicate your preferred method for receiving any refund or making payments if you owe taxes. Fill out the account information if opting for direct deposit.

- Review all the information you have provided for completeness. Once satisfied, save your changes, download, print the form or share it as necessary.

Complete your New York State Income Tax form online today and submit it for a hassle-free experience!

New York State payroll taxes for 2024 Calculating taxes in New York is a little trickier than in other states. The state as a whole has a progressive income tax that ranges from 4. % to 10.9%, depending on an employee's income level. There is also a supplemental withholding rate of 11.70% for bonuses and commissions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.