Loading

Get Mo Dor Mo-60 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO DoR MO-60 online

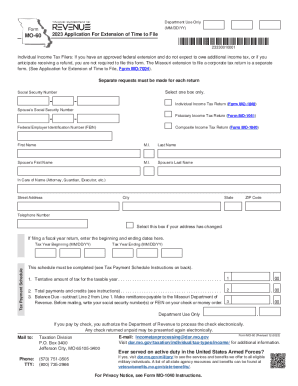

Filling out the MO DoR MO-60 form online is an essential process for individuals and businesses seeking an extension for their tax filing in Missouri. This guide will provide clear, step-by-step instructions to help you navigate each section of the form with confidence.

Follow the steps to complete the MO DoR MO-60 form online.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Identify whether you need to file this form based on your tax situation. If you have an approved federal extension and do not expect to owe additional income tax, you may not need to file this form.

- Select the appropriate box to indicate the type of return for which you are requesting an extension, ensuring only one box is selected.

- Enter your Social Security Number (SSN) and, if applicable, your spouse’s SSN. Ensure this information is accurate to avoid processing delays.

- Complete the taxpayer identification section by entering the Federal Employer Identification Number (FEIN) if applicable.

- Fill in your first name, middle initial, last name, and, if applicable, your spouse's name in the designated fields.

- Provide your mailing address, including the street address, state, city, and ZIP code. If your address has changed, mark the corresponding box.

- Include your telephone number for contact purposes.

- If filing a fiscal year return, specify the beginning and ending dates for the tax year in the provided fields.

- Complete the Tax Payment Schedule by entering the tentative amount of tax for the taxable year along with total payments and credits, and calculate the balance due.

- Review your entries carefully. Ensure that all required information is accurately filled out and matches the supporting documents.

- Once you have completed the form, you can save your changes, download the filled form, print it, or share as necessary.

Complete your MO DoR MO-60 form online today for a smooth tax filing experience.

Related links form

If you have a refund coming from the IRS—as about three out of four taxpayers do every year—then there is no penalty for failing to file your tax return by the deadline, even if you don't ask for an extension.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.