Loading

Get Mi Dot Mi-1040cr-2 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI DoT MI-1040CR-2 online

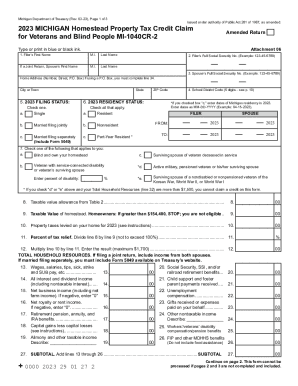

Filling out the Michigan Homestead Property Tax Credit Claim for Veterans and Blind People (MI-1040CR-2) online can be a straightforward process with the right guidance. This guide will walk you through each section of the form in a clear and supportive manner.

Follow the steps to complete your form accurately.

- Click the ‘Get Form’ button to obtain the form and open it for editing.

- Enter your details in Section 1, providing your first name, middle initial, and last name. If you are filing jointly, also include your spouse's name.

- Input your Social Security numbers in the designated fields for both yourself and your spouse.

- Complete your home address, ensuring to include your ZIP code and city or town.

- Indicate your 2023 filing status by checking one of the options provided.

- State your residency status for 2023 by checking the appropriate box based on your living situation.

- Select the applicable options regarding your eligibility, checking all that apply under the specified conditions.

- Provide your school district code, ensuring it is accurate as per the requirements outlined.

- Fill in the taxable value allowance and the taxable value of your homestead, taking care to conform to the eligibility limits.

- Enter the property taxes levied on your home for 2023, ensuring correctness for accurate credit calculation.

- Calculate the percent of tax relief by dividing your taxable value allowance by the taxable value. Ensure this does not exceed 100%.

- Multiply the property taxes by your percent of tax relief to calculate any potential tax relief credit.

- Report your total household resources, combining all income sources as instructed, particularly for joint returns.

- Continue filling out additional necessary lines that calculate other adjustments and your final total household resources.

- After completing the form, review all information carefully. You can save changes, download, print, or share your completed form as needed.

Complete your MI DoT MI-1040CR-2 form online today for efficient processing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.