Loading

Get Ca Ftb Schedule D-1 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB Schedule D-1 online

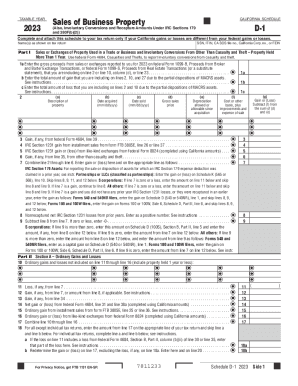

Filling out the CA FTB Schedule D-1 can seem complex, but with a structured approach, it becomes manageable. This guide will provide you with step-by-step instructions to help you complete the form accurately online.

Follow the steps to successfully complete the form.

- Press the 'Get Form' button to access the document and open it for editing.

- Begin with the top section where you enter your name(s) as shown on your tax return, followed by your Social Security Number (SSN), Individual Taxpayer Identification Number (ITIN), California Secretary of State (SOS) file number, California corporation number, or Federal Employer Identification Number (FEIN).

- In Part I, provide details about the sales or exchanges of property used in your trade or business. This includes entering the gross proceeds from sales or exchanges as reported to you, the total gain from partial dispositions of MACRS assets, and the total loss likewise.

- List the description of the property, acquisition date (formatted mm/dd/yyyy), sale date, gross sales price, and depreciation allowed or allowable since acquisition. Ensure to calculate your gain or loss correctly by subtracting the cost or other basis from your total sales price.

- Continue to complete the sections regarding IRC Section 1231 assets and any gains or losses from property disposals. Follow the specific instructions for your type of entity (partnerships, S corporations, and individual filers) to ensure you report correctly.

- For ordinary gains and losses, include all relevant details such as acquisition and sale dates, gross sales price, and the corresponding basis. Accurately summarize the totals for each category.

- After finishing all sections, review your entries carefully for accuracy. At this point, you can save changes, download a copy for your records, print the form, or share it as necessary.

Ensure your tax documents are accurate and complete by filing the necessary forms online today.

Schedule D is required when a taxpayer reports capital gains or losses from investments or the result of a business venture or partnership. The calculations from Schedule D are combined with individual tax return form 1040, where it will affect the adjusted gross income amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.