Loading

Get Ct-706/709 Ext, Application For Estate And Gift Tax Return Filing ... - Ct

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the CT-706/709 EXT, Application For Estate And Gift Tax Return Filing online

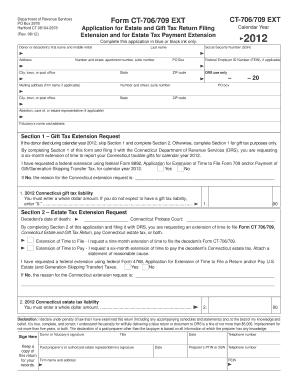

Filling out the CT-706/709 EXT form is an essential step for individuals seeking an extension for estate and gift tax return filing in Connecticut. This guide provides clear instructions to help users navigate each section of the form effectively.

Follow the steps to complete the CT-706/709 EXT form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the donor or decedent’s first name, middle initial, and last name, followed by the address details such as number and street, apartment, suite number, PO box, city or town, state, and ZIP code.

- If applicable, enter the Federal Employer ID Number (FEIN) and Social Security Number (SSN) of the donor or decedent.

- Fill out Section 1 if the donor is alive. Check the box indicating whether you have requested a federal extension using federal Form 8892. Enter the 2012 Connecticut gift tax liability as a whole dollar amount.

- If the donor has died, proceed to Section 2. Enter the decedent’s date of death and the Connecticut Probate Court information. Choose the type of extension being requested—either for filing or payment—or both.

- Indicate whether you have requested a federal extension using federal Form 4768 and provide a reason for the Connecticut extension request if needed. Enter the Connecticut estate tax liability as a whole dollar amount.

- Sign the declaration to affirm the accuracy of the information. Include the signature, title, date, and contact information where specified.

- After completing the form, save changes, and choose one of the following: download the form, print it, or share it as necessary.

Complete and submit your forms online today for a smooth filing experience.

If you don't file the gift tax return as you should, you could be responsible for the amount of gift tax due as well as 5% of the amount of that gift for every month that the return is past due. If you fail to pay the penalty, you could be responsible for the amount of the gift tax due and .

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.