Loading

Get Mi Amended Minimum Requirements For Anti-steering Loan Options Disclosure Form 2012-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI Amended Minimum Requirements for Anti-Steering Loan Options Disclosure Form online

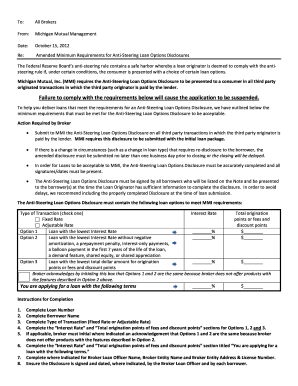

Completing the MI Amended Minimum Requirements for Anti-Steering Loan Options Disclosure Form online is an essential step in ensuring compliance with federal regulations. This guide provides clear and supportive instructions to help you navigate each section of the form efficiently.

Follow the steps to accurately complete the form.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Begin filling in the form by completing the Loan Number field, providing a unique identifier for the loan application.

- Enter the Borrower Name section with the full legal names of all borrowers involved in the transaction.

- Select the Type of Transaction by checking either 'Fixed Rate' or 'Adjustable Rate', depending on the loan options being presented.

- Fill out the Interest Rate and Total origination points or fees and discount points for each of the three Options provided, ensuring accurate and honest reflection of the offered loan terms.

- If applicable, initial the box acknowledging that Options 1 and 2 are the same, confirming the absence of features described in Option 2.

- Complete the section titled 'You are applying for a loan with the following terms' by entering the Interest Rate and Total origination points or fees and discount points.

- Provide details for the Broker Loan Officer Name, Broker Entity Name, Broker Entity Address, and License Number.

- Ensure that the Disclosure is signed and dated by the Broker Loan Officer and by each borrower listed.

Get started on completing your documentation online today!

Brokers who are preparing their own initial disclosure package are responsible for the Anti-Steering disclosure. As a reminder, the Anti-Steering form must be fully completed and provided to the borrower within 3 days of the application date.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.