Loading

Get Reset Form Department Of Revenue Services Po Box 2978 Hartford Ct 06104-2978 (rev - Ct

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Reset Form Department of Revenue Services PO Box 2978 Hartford CT 06104-2978 (Rev - Ct online

This guide provides clear, step-by-step instructions for filling out the Reset Form Department of Revenue Services PO Box 2978 Hartford CT 06104-2978 (Rev - Ct). Whether you are new to completing forms or familiar with the process, this comprehensive approach will ensure you accurately provide the necessary information.

Follow the steps to complete the reset form accurately.

- Press the ‘Get Form’ button to access the document and open it in your preferred editor.

- Begin at the top of the form where you will need to enter the donor's first name, middle initial, and last name in the designated fields.

- In the address section, provide the full mailing address, including the street address, city, state, and ZIP code.

- Fill in the donor's Social Security Number (SSN) as prompted, ensuring the correct format is used.

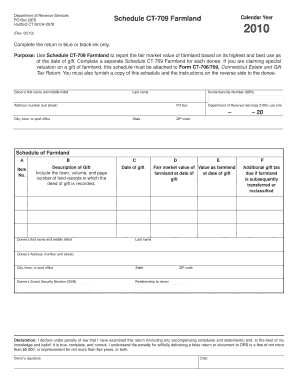

- Complete the 'Schedule of Farmland' section where you will document details for each gift. Use a separate schedule for each donee.

- Within the Schedule of Farmland, fill in the 'Item No.' in Column A for each gift. This should correspond to the information from Form CT-706/709, Schedule A.

- In Column B, include a complete description of the gift, noting the town, volume, and page number associated with the deed of gift.

- Provide the 'Date of gift' in Column C.

- For Column D, enter the fair market value of the farmland at the date of the gift.

- Column E requires the value of the farmland at the date of gift based on its current use.

- Calculate additional gift tax due in Column F if the farmland is transferred or reclassified within ten years.

- Sign and date the declaration section as the donor, confirming the accuracy of your information.

- Make sure to attach this schedule to your Form CT-706/709 before mailing.

- Once complete, save your changes, and choose to download, print, or share the form as needed.

Complete your documents online today for efficient processing.

If you file your return with the wrong address, that can't really be undone. You'll need to contact the IRS directly to update your address (you can use their toll-free number: 1-800-829-1040). If your return(s) are rejected by the IRS, you can simply change your address before resending your tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.