Loading

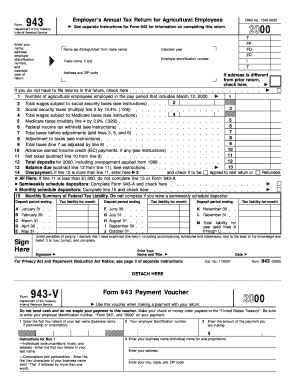

Get See Separate Instructions For Form 943 For Information On Completing This Return - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the See Separate Instructions For Form 943 For Information On Completing This Return - Irs online

Filling out Form 943, the Employer's Annual Tax Return for Agricultural Employees, requires attention to detail and accuracy. This guide will provide step-by-step instructions to help users complete the form effectively online.

Follow the steps to accurately complete your online form

- Click the ‘Get Form’ button to access and open the form in your preferred editing tool.

- Fill in your name, including any trade name, at the top of the form as indicated. Provide your employer identification number and the calendar year for the return.

- Enter your address and ZIP code. If your address has changed from your prior return, check the corresponding box.

- Indicate the number of agricultural employees employed during the pay period that includes March 12 of the return year.

- Provide the total wages subject to social security taxes based on the instructions given. Calculate social security taxes by multiplying the amount from the previous line by 12.4%.

- Similar to the social security tax, fill in the total wages subject to Medicare taxes and calculate Medicare taxes using 2.9%.

- Include the total amount of federal income tax withheld during the specified period.

- Calculate the total taxes before adjustments by adding the social security taxes, Medicare taxes, and federal income tax withheld.

- If applicable, enter any advance earned income credit payments.

- Determine your net taxes by subtracting the advance earned income credit payments from the total taxes.

- Record the total deposits for the year, which may include any overpayments from the prior year.

- Calculate the balance due by subtracting total deposits from net taxes. If applicable, indicate any overpayment and whether it will be applied to the next return.

- If required, complete the monthly summary of federal tax liability, detailing each month’s tax liability.

- Sign and date the form, declaring it to be complete and accurate to the best of your knowledge.

- Finally, save your changes, and download the filled form for your records. You may print or share it as needed.

Complete your documents online to simplify the tax return process.

Yes, you can file an original Form 1040 series tax return electronically using any filing status. Filing your return electronically is faster, safer, and more accurate than mailing your tax return because it's transmitted electronically to the IRS computer systems.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.