Loading

Get Ira Application - Mutualfundstrategist .com

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRA APPLICATION - MutualFundStrategist.com online

Filling out your IRA application online can be a straightforward process with the right guidance. This user-friendly guide will help you navigate each section of the IRA APPLICATION - MutualFundStrategist.com, ensuring that you provide all necessary information accurately.

Follow the steps to complete your IRA application effectively.

- Press the ‘Get Form’ button to access the application and open it in your preferred editor.

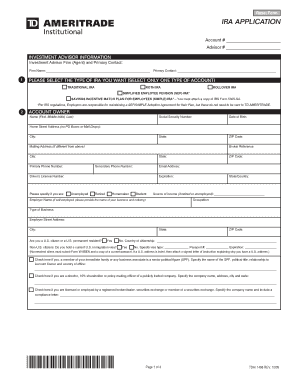

- Provide your account number and advisor number at the top of the form. This information helps to identify your specific application.

- Fill in the investment advisor information. Include the firm name and primary contact's details to formalize the relationship.

- Select the type of IRA you wish to establish. Choose only one from options such as Traditional IRA, Roth IRA, SEP IRA, Rollover IRA, or SIMPLE IRA. Ensure you understand the implications of your choice.

- Complete the account owner section with your personal details. This includes your full name, Social Security number, date of birth, and address. If applicable, provide alternative mailing address.

- Indicate your employment status and source of income if you are retired or unemployed. Provide additional information about your employer if self-employed.

- Designate your beneficiaries in the appropriate section. Fill in their names, Social Security numbers, and relationships to you. Ensure that primary and contingent beneficiaries are clearly identified.

- In the custody services section, specify your preferences for receiving confirmations and statements. Whether you prefer electronic or paper formats, make your selections accordingly.

- Review and initial the advisor authorization section to grant your investment advisor the authority to execute trades on your behalf.

- Acknowledge the agreement by signing and dating the application at the bottom. Ensure all the information is accurate and complete before submission.

- Once completed, save your changes, and choose to download, print, or share the form based on your requirements.

Start your application process now by filling out the IRA APPLICATION online.

A mutual fund IRA is a type of IRA account that invests the money it contains in a mutual fund. IRAs, or individual retirement accounts, are personal investment accounts that allow individuals to save money for retirement easily.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.