Loading

Get Dor Sales & Use Tax E-file Transmission

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DOR Sales & Use Tax E-File Transmission online

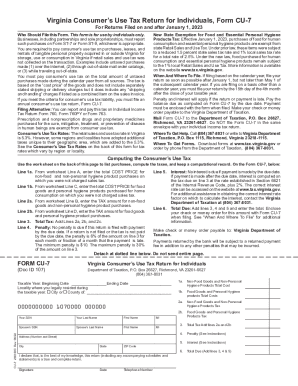

Filling out the DOR Sales & Use Tax E-File Transmission is a crucial step for individuals who need to report consumer's use tax on their untaxed purchases. This guide provides clear, step-by-step instructions to help you complete the form online effectively.

Follow the steps to successfully complete the DOR Sales & Use Tax E-File Transmission.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your personal information, including your Social Security Number, name, and address in the designated fields. Ensure accuracy to avoid processing delays.

- Indicate the taxable year by entering the beginning and ending dates. This information helps determine the relevant period for tax calculation.

- Complete Line 1a by entering the total cost price for non-food and non-personal hygiene product purchases. Refer to your worksheet for this value.

- Fill in Line 1b with the total cost price for food goods and personal hygiene products purchased for home consumption that were not taxed.

- Calculate the tax for non-food goods and non-personal hygiene products and enter the amount in Line 2a based on your worksheet.

- Compute the tax for food goods and personal hygiene products and enter this value in Line 2b using the corresponding worksheet calculation.

- Total the taxes calculated on Lines 2a and 2b and enter the result on Line 3.

- If applicable, check the instructions regarding penalties and interests and complete Lines 4 and 5 accordingly.

- Sum Lines 3, 4, and 5 and enter the total due on Line 6 which represents the total amount you need to pay.

- Complete the declaration at the bottom of the form, sign, and date to verify the accuracy of your return.

- Save your changes, and once finished, you can download, print, or share the form as necessary.

Complete your DOR Sales & Use Tax E-File Transmission online today to ensure your tax obligations are properly filed.

Use tax is imposed on the use, storage or consumption of tangible personal property shipped into Missouri from out of state. The state use tax rate is also imposed at a rate of 4.225%. In addition, cities and counties may impose local use tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.