Loading

Get Va 763-s 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA 763-S online

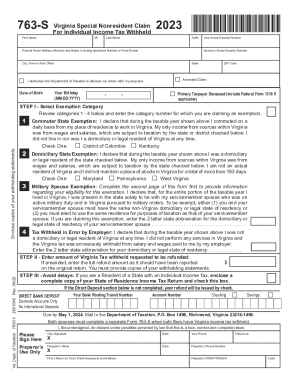

The VA 763-S form is used for individuals who are nonresidents seeking a refund of Virginia income tax withheld. This guide provides step-by-step instructions to support users in completing this form online effectively.

Follow the steps to successfully complete the VA 763-S online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your first name, last name, and suffix, as applicable. Ensure that all details match your identification documents.

- Enter your present home address, including any apartment number or rural route. Include the city, state, and ZIP code.

- Fill in your date of birth in the format MM-DD-YYYY along with your Social Security number.

- Indicate whether the claim is amended by checking the appropriate option.

- If applicable, provide the amount of Virginia tax withheld that you are requesting to be refunded in STEP II. Include copies of withholding statements.

- If you are a resident of a state with an income tax, include a complete copy of your state income tax return in STEP III, and check the provided box.

- Complete the Direct Bank Deposit section, providing your bank routing number and account number. Select whether it is a checking or savings account.

- Review all sections for accuracy, then sign and date the form, providing your phone number and the preparer's information if applicable.

- At the final step, save your changes, then download, print, or share the completed form as needed.

Complete your VA 763-S form online today to ensure timely processing of your refund.

File Form 763, the nonresident return, to report the Virginia source income received as a nonresident.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.