Loading

Get Georgia Consol

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Georgia Consol online

Completing the Georgia Consol form is a crucial step for corporations seeking permission to file a consolidated income tax return in Georgia. This guide provides clear instructions to help users fill out the form accurately and efficiently, ensuring compliance with state regulations.

Follow the steps to complete the Georgia Consol form online.

- Click 'Get Form' button to access the Georgia Consol form and open it in your preferred editing tool.

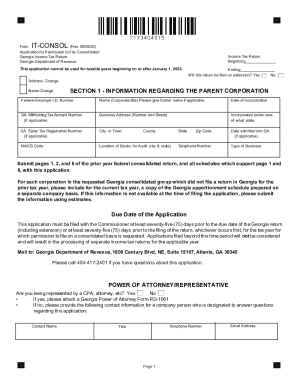

- Begin by filling in the income tax return years at the top of the form, specifying the beginning and ending dates. Remember, this application cannot be used for taxable years starting on or after January 1, 2023.

- In Section 1, provide information about the parent corporation, including the Federal Employer Identification Number, the corporate name (including any former name), date of incorporation, and applicable registration numbers.

- Attach pages 1, 2, and 6 of the prior year's federal consolidated return, along with all supporting schedules.

- In Section 2, identify all members included in the requested consolidation group. Confirm compliance with the regulations by checking 'Yes' or 'No'.

- Complete Section 3 by designating a member authorized to receive notices regarding the application on behalf of the entire group. Provide the necessary contact details.

- In Section 4, answer the general questions about net operating loss and expenses related to entities not included in the Georgia group. Provide detailed answers and attach additional schedules if necessary.

- Finally, ensure all sections have been completed and accurately checked. Sign and date the application, providing the names and titles of the officers. Once completed, users can save changes, download, print, or share the form as needed.

Take the next step in managing your corporate tax filings by completing the Georgia Consol process online.

The following businesses must file an income tax return with the state of Georgia: Corporations, partnerships, or LLCs that do business or own property in Georgia or receive income from Georgia sources. Any partnership or LLC that is treated as a partnership, with partners or members who reside in Georgia.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.