Loading

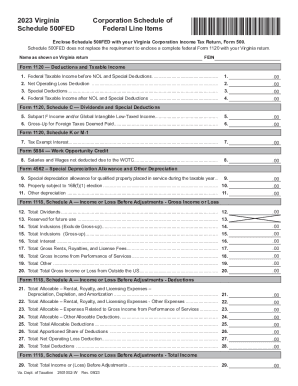

Get Desktop - Virginia Supported Business Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Desktop - Virginia Supported Business Forms online

This guide provides a clear and comprehensive walkthrough for filling out the Desktop - Virginia Supported Business Forms online. Whether you are familiar with tax documents or a first-time user, this guide will help you complete the forms accurately and easily.

Follow the steps to fill out the Desktop - Virginia Supported Business Forms online effectively.

- Click the ‘Get Form’ button to access the Virginia Supported Business Forms. This action will allow you to obtain the form and open it in your preferred editor for completion.

- Begin by entering the name as shown on the Virginia return. This ensures that your form is correctly associated with your corporation's income tax return.

- Provide your Federal Employer Identification Number (FEIN) in the designated field. This number is essential for identifying your corporation with the IRS.

- Move to the section for reporting your Federal Taxable Income before deductions. Input the amounts in the correct fields for each line as indicated, ensuring accuracy.

- Next, input the Net Operating Loss Deduction, followed by any Special Deductions applicable to your corporation.

- Continue filling out the form by providing the Federal Taxable Income after accounting for any deductions. Ensure all values are clearly marked and accurate.

- Fill in the details for Subpart F Income or Global Intangible Low-Taxed Income (if applicable) and provide the Gross-Up for Foreign Taxes Deemed Paid.

- Proceed to the sections concerning Tax Exempt Interest and Salaries and Wages not deducted due to the Work Opportunity Tax Credit.

- Complete the Special Depreciation Allowance and other related depreciation sections, ensuring you have captured all relevant figures.

- Finalize by reviewing all entries for accuracy. After verifying the information, you can save your changes, download the completed form, print it, or share it as needed.

Start filling out your Virginia Supported Business Forms online today to ensure a smooth and accurate submission.

Pay online through Paymentus, or call 1.833. 339.1307 (1.833. 339.1307)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.