Loading

Get Va 502w 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA 502W online

Filling out the VA 502W form online can seem challenging, but this guide will walk you through the process step-by-step. Whether you are familiar with tax forms or this is your first experience, our clear instructions will help you complete the form accurately and efficiently.

Follow the steps to complete the VA 502W form online.

- Click ‘Get Form’ button to access the VA 502W form and open it in your preferred online editor.

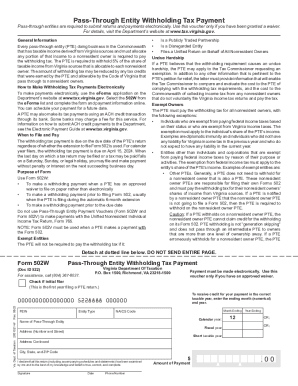

- Provide the pass-through entity’s (PTE) federal employer identification number (FEIN) in the designated field.

- Select the entity type from the options available, ensuring the correct code corresponds to your entity type: SC for S Corporation, PG for General Partnership, PL for Limited Partnership, LL for Limited Liability Company, LP for Limited Liability Partnership, NZ for Nonprofit Organization, or OB for Other.

- Enter the 6-digit North American Industry Classification System (NAICS) code relevant to your business.

- Indicate the month and year that the payment relates to, ensuring it aligns with the tax year you are filing for.

- Complete the name and address section of the form with the PTE’s official registered address.

- Calculate the amount of withholding tax due by either computing the taxable income of the PTE or the individual nonresident owners, applying a 5% withholding rate, and adjusting for any applicable tax credits.

- Enter the total withholding amount in the payment field to finalize your entry.

- Sign and date the form in the designated spaces, and include your contact phone number.

- Once all fields are completed accurately, review for any errors, and then save your changes, download a copy, or print it for your records.

Complete your VA 502W form online to ensure timely submission and compliance with taxation regulations.

Form 502W - Virginia Pass-Through Withholding Tax Payment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.