Loading

Get Ia Ia 1065 2007-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IA IA 1065 online

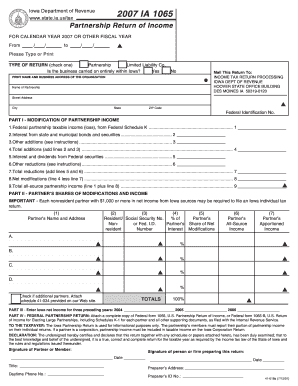

The IA IA 1065 form is essential for partnerships and limited liability companies in Iowa to report their income for tax purposes. This guide provides a step-by-step approach to help you complete the form accurately and efficiently online.

Follow the steps to successfully complete the IA IA 1065 online

- Click the ‘Get Form’ button to access the IA IA 1065 document and open it in your online form editor.

- Indicate the calendar year or other fiscal year for which you are filing, filling in the appropriate dates at the top of the form.

- Select the type of return by checking the corresponding box for either Partnership or Limited Liability Company.

- Indicate if the business is carried out entirely within Iowa by selecting 'Yes' or 'No'.

- Provide the mailing address for your return, including the name of the partnership, street address, city, state, and ZIP code.

- Enter the Federal Identification Number assigned to the partnership.

- Proceed to Part I and report federal partnership taxable income or loss from Federal Schedule K as instructed.

- Complete the addition and subtraction calculations for modifications of partnership income as outlined in Part I.

- In Part II, list all nonresident partners and report their details including name, address, and social security or Federal identification number.

- Ensure you allocate each partner’s share of modifications and income accurately, filling out the required percentage fields.

- For Part III, enter the Iowa net income for the three previous years as required.

- Attach a complete copy of the Federal form 1065 and any necessary schedules.

- In the Declaration section, certify and sign the return, including the date and contact number.

- Once all fields are complete, review your entries, save your changes, and download or print the completed form for submission.

Complete your IA IA 1065 form online today to ensure timely and accurate tax reporting.

Almost everyone must file a state income tax return in Iowa, including: Residents with at least $9,000 in net income for individuals or $13,500 for married taxpayers. Part-year residents (for the part of the year they resided in Iowa)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.