Loading

Get 2023 Maine Minimum Tax Credit And Carryforward To 2024 ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

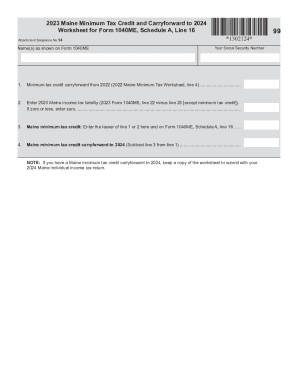

How to fill out the 2023 Maine Minimum Tax Credit and Carryforward to 2024 online

This guide provides step-by-step instructions on completing the 2023 Maine Minimum Tax Credit and Carryforward to 2024 form. Designed for clarity and ease of use, it helps you navigate each section effectively while filing online.

Follow the steps to complete the form with confidence.

- Press the ‘Get Form’ button to access the form and open it in your chosen editor.

- In the first section, enter your name as shown on Form 1040ME. This ensures that your information matches your tax records.

- Next, input your Social Security number in the designated field. This number is crucial for identifying your tax return.

- For line 1, record the minimum tax credit carryforward from 2022, which you can find on the 2022 Maine Minimum Tax Worksheet, line 4.

- On line 2, enter your 2023 Maine income tax liability. This is calculated as line 22 from Form 1040ME minus line 23, excluding the minimum tax credit. If your liability is zero or less, simply enter zero.

- Line 3 requires you to determine the Maine minimum tax credit. Enter the lesser amount from line 1 or line 2 here. This value will also be reported on Form 1040ME, Schedule A, line 16.

- Lastly, in line 4, calculate the Maine minimum tax credit carryforward to 2024 by subtracting the amount from line 3 from line 1. This is important for your future tax planning.

- Ensure you keep a copy of the worksheet for your records, particularly if you have a carryforward to 2024. This will need to be submitted with your 2024 Maine individual income tax return.

- Once you have filled out all necessary fields, you can save your changes, download the document, print it, or share it as needed.

Complete your form online today for a smoother tax filing experience.

Because the amount of your gains and losses may be different for the AMT, the amount of any capital loss carryover may also be different for the AMT.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.