Get Support For The Ssi Savings Penalty Elimination Act

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Support For The SSI Savings Penalty Elimination Act online

This guide provides a clear and supportive framework for completing the Support For The SSI Savings Penalty Elimination Act form online. By following the instructions outlined below, users can confidently fill out the required information accurately and efficiently.

Follow the steps to complete the form with ease.

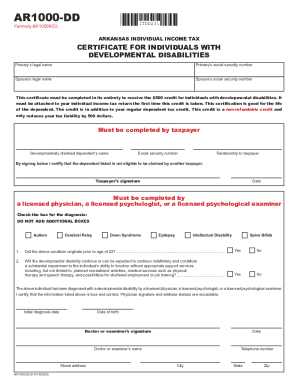

- Press the ‘Get Form’ button to acquire the form and open it in your document editor.

- Enter the primary individual’s legal name in the designated field. Ensure that the name matches the identification documents.

- Provide the primary individual’s social security number in the next section. Double-check for accuracy to avoid processing delays.

- Input the spouse’s legal name and social security number, if applicable. This step is required only if a spouse is involved.

- Complete the section with the name and social security number of the developmentally disabled dependent, as well as the relationship to the taxpayer.

- In the certification area, verify and confirm that you are not attempting to claim the dependent listed by another taxpayer by signing with your name and including the date.

- Provide relevant information about the developmental disability, including selected conditions, initial diagnosis date, and physician information. Be sure to include signatures where required.

- Review all entered information for accuracy. Once confirmed, you may save changes, download, print, or share the completed form as necessary.

Start completing your documents online today for a smoother experience.

36 months To reduce the potential of abuse, SSA will review all asset transfers you complete within the 36 months prior to applying for SSI. When officials detect an improper transfer for less than fair market value, the penalty is calculated ing to a formula: The total value of the assets that were transferred. Divided by. Is There A “Lookback” Period For Transfers Under SSI Rules? steinhardtlawfirm.com https://.steinhardtlawfirm.com › is-there-a-lookback... steinhardtlawfirm.com https://.steinhardtlawfirm.com › is-there-a-lookback...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.