Loading

Get Fl Dr-15dss 2024-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-15DSS online

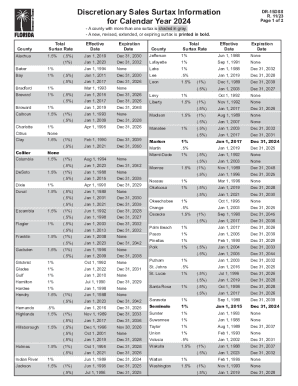

The FL DR-15DSS form is essential for reporting discretionary sales surtax rates for counties in Florida. This guide provides step-by-step instructions to help users easily navigate the online form-filling process.

Follow the steps to complete the FL DR-15DSS online

- Press the ‘Get Form’ button to access the form and open it in the online editing tool.

- Review the form for important details. The FL DR-15DSS consists of various sections including county names, total surtax rates, effective dates, and expiration dates. Ensure you are familiar with these areas before proceeding.

- Identify your county from the list provided on the form. Each county has different surtax rates that may vary over time. Pay attention to whether there are any recent changes marked in bold.

- Fill out the required fields accurately. Enter the total surtax rates, effective dates, and expiration dates as necessary for your county.

- Carefully check all the information entered to ensure accuracy. Errors could lead to complications in processing.

- Once all fields are filled and you have reviewed the information, save your changes. You can also download, print, or share the completed form based on your needs.

Complete your FL DR-15DSS form online today to ensure timely submission and compliance.

You may file and pay tax online or you may. complete this return and pay tax by check. or money order and mail to: Florida Department of Revenue.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.