Loading

Get 12c-1.051 : Forms - Florida Administrative Rules, Law ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 12C-1.051 : Forms - Florida Administrative Rules online

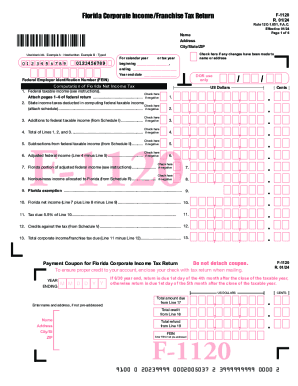

Filing the 12C-1.051 form is a crucial step for corporations in Florida to report their income tax accurately. This guide provides clear and detailed instructions on how to complete the form online, ensuring you have all the necessary information at your fingertips.

Follow the steps to fill out the form successfully.

- Press the ‘Get Form’ button to access the form and open it in the appropriate interface.

- Enter your corporation's name, address, city, state, and ZIP code in the designated fields. Make sure to use black ink if submitting a paper version.

- If there have been any changes made to your name or address, check the appropriate box provided on the form.

- Indicate the tax year for which you are filing the return, either for the calendar year 2015 or a tax year beginning in 2015. Fill in the applicable start and end dates.

- Calculate your federal taxable income based on instructions provided, and enter this value in the designated line. If your income is negative, check the corresponding box.

- Proceed to list the state income taxes deducted, in accordance with your federal taxable income. If negative, check the box provided.

- Complete the addition and subtraction of federal taxable incomes as instructed, entering each value on the respective lines and checking the boxes when necessary if values are negative.

- Attach all required schedules and documentation as stated in the form instructions, ensuring everything is complete.

- Review all entries for accuracy, then proceed to save any changes made, and options to download, print, or share the completed form.

Complete your Florida corporate income tax return online to ensure timely and accurate filings.

“S” corporations are not subject to the tax, except for taxable years when they are liable for the federal tax under the Internal Revenue Code. An “S” corporation must file a Florida Corporate Income/Franchise and Emergency Excise Tax Return (Form F-1120, incorporated by reference in rule 12C-1.051, F.A.C.)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.