Loading

Get Pr 480.6d 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR 480.6D online

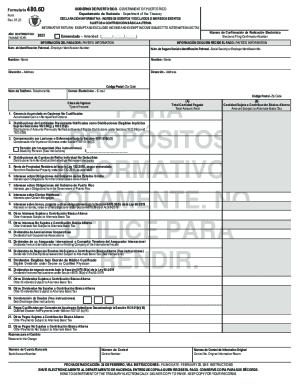

Completing the PR 480.6D form online is an essential step for anyone engaged in trade or business in Puerto Rico. This guide provides clear, step-by-step instructions to ensure that you fill out the form accurately and efficiently.

Follow the steps to fill out the PR 480.6D effectively.

- Press the ‘Get Form’ button to access the form and open it in an online editor.

- Select the tax year you are reporting for by entering the relevant year in the designated field.

- Provide your confirmation number for electronic filing, ensuring all information is exactly correct.

- Fill out the payee's information, including their name, address, and contact details, ensuring that all fields are accurately completed.

- Complete the payer's information section, mirroring the previous fields for consistency.

- Enter the total amount paid, which is crucial for the computation of the alternate basic tax. Ensure the amount meets the minimum reporting threshold of $500.

- Indicate the amounts subject to alternate basic tax by populating relevant categories, ensuring you understand which type of income is applicable.

- Once all information is accurately detailed, review your entries for any errors or omissions.

- Save the changes made to the form, and then proceed to download or print a copy for your records.

- Submit the form electronically to the Department of the Treasury, ensuring you retain a copy for your records.

Be sure to complete your forms online for a smooth and efficient filing process.

Form 480.6A is issued by the government of Puerto Rico for the filing of informative returns on income not subject to withholding.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.