Loading

Get Pr 480.30(ii) 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PR 480.30(II) online

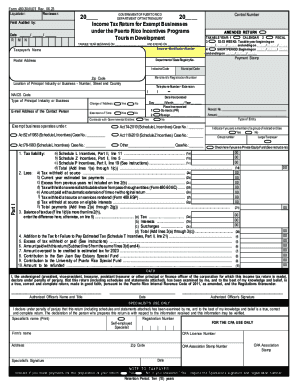

Completing the PR 480.30(II) form online is an essential step for businesses under the Puerto Rico Incentives Programs to report their income tax. This guide will help you navigate the form's sections and fields effectively.

Follow the steps to complete the PR 480.30(II) form with ease.

- Click the ‘Get Form’ button to access the PR 480.30(II) document and prepare to complete it.

- Enter the taxable year beginning and ending dates in the designated fields. Ensure the dates are accurate to avoid any processing issues.

- Fill in the Taxpayer's Name and Employer Identification Number. These identifiers are crucial for your filing.

- Provide your Postal Address and Department of State Registry Number. Be precise to ensure all correspondence is directed correctly.

- Select the type of tax return you are submitting: Amended Return, Calendar Year, Fiscal Year, or Short Period. Ensure this reflects your actual filing circumstances.

- Detail your business information in sections, including the Merchant's Registration Number, Municipal Code, and Control Number.

- Complete the income and tax liability section accurately by entering all relevant financial data required by the form.

- Review all entries for accuracy. Ensure your responses are complete and supported by documentation where necessary.

- Once all fields are completed and verified for accuracy, save your changes. You may have options to download, print, or share the form as necessary.

Start the process of filing your PR 480.30(II) online today for a smooth and compliant submission!

Qualifying businesses, foreign or local, with an office in Puerto Rico get a 4% fixed income tax rate under Act 20 for exporting services. Under Act 22, the most controversial of the two, individual investors looking to benefit from the tax breaks must not have lived in Puerto Rico between 2006 and 2012.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.