Loading

Get Chapter 12-26

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CHAPTER 12-26 online

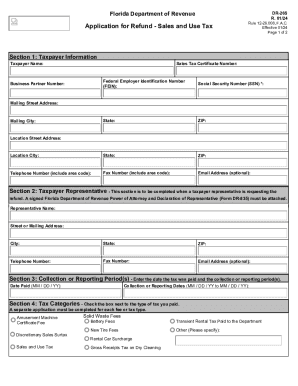

Filling out the CHAPTER 12-26 application for refund is an essential step for taxpayers seeking to recover sales and use tax payments. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete your application for refund.

- Click the ‘Get Form’ button to access the CHAPTER 12-26 application and open it in your preferred document editor.

- Fill out Section 1 with your taxpayer information, including your taxpayer name, sales tax certificate number, federal employer identification number (FEIN), and social security number (SSN). Ensure you also provide your location city, state, ZIP code, telephone number, and email address, if applicable.

- If you are using a taxpayer representative, complete Section 2 with their information. This includes the representative's name, address, telephone number, and optional email address. Don't forget to attach the signed Power of Attorney form.

- In Section 3, enter the collection or reporting periods and the date the tax was paid. Ensure to use the correct MM/DD/YY format.

- Proceed to Section 4 and check the appropriate boxes to indicate the tax categories for which you are requesting a refund. You must complete a separate application for each tax type.

- In this section, check the box next to the reason for your refund claim, such as amended replacement return or duplicate payment.

- Next, in Section 5, enter the refund amount you are claiming and provide a brief explanation for this refund.

- Finally, sign the application under the authorization and signature section, affirming that the information provided is true. Ensure the date is included and, if applicable, the representative also signs.

- After completing the form, you can either mail it to the Florida Department of Revenue at the provided address or opt to send it via fax. Ensure to keep a copy for your records.

Start filling out your CHAPTER 12-26 application for refund online today to ensure you receive your entitled tax refunds.

Solomon asserts that those who pursue godliness and truth (Proverbs 1:7) can provide genuine help for others. Those who are selfish and ungodly will draw people in the wrong direction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.