Loading

Get Ut Tc-62m Schedule A 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT TC-62M Schedule A online

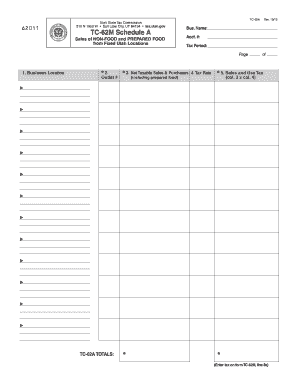

The UT TC-62M Schedule A is a vital form for reporting sales of non-food and prepared food from fixed Utah locations. This guide provides a clear, step-by-step approach to ensure accurate and efficient completion of the form online.

Follow the steps to complete the UT TC-62M Schedule A online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Column 1 where you will find preprinted locations from Tax Commission records. Verify these locations and make any necessary corrections, including adding new locations or deleting closed ones. If you make changes, include the start or closing date as applicable.

- In Column 2, enter the outlet numbers assigned by the Tax Commission. If you need assistance with outlet numbers, register online at Taxpayer Access Point (TAP) or contact the Tax Commission directly.

- Proceed to Column 3, where you will enter the net amount of non-food and prepared food items subject to sales and use tax for each location listed in Column 1. Ensure that these amounts are included in the total sales reported on TC-62M, line 7.

- Move to Column 4. This column contains the preprinted tax rate for each location. It is advisable to verify the tax rate online before submission, as rates can change quarterly.

- In Column 5, calculate the total sales and use tax owed by multiplying each net taxable amount in Column 3 by the corresponding tax rate in Column 4. Total these amounts and ensure they are included in form TC-62M, line 8a.

- Review all entries for accuracy. Once completed, save your changes. You may then download, print, or share the form as needed.

Start completing your documents online today!

Common Exemptions from Utah Sales and Use Tax: Medical Devices, Equipment, and Supplies. Durable Medical Equipment includes equipment for home use, including repair and replacement parts. Mobility-Enhancing Equipment includes equipment sold under a doctor's written prescription, including repair and replacement parts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.