Loading

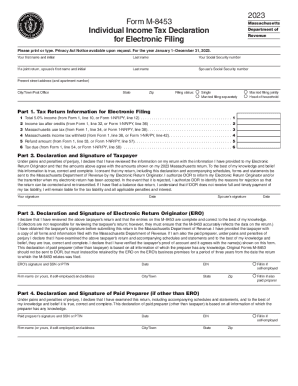

Get 2023 Form M-8453 Individual Income Tax Declaration For ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2023 Form M-8453 Individual Income Tax Declaration online

Filling out the 2023 Form M-8453 Individual Income Tax Declaration is an essential part of filing your income tax return electronically. This guide will provide you with step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to fill out your tax declaration form online.

- Click the ‘Get Form’ button to obtain the form and access it in your preferred editor.

- Begin by entering your first name and initial, followed by your last name. If you are filing a joint return, provide your spouse's first name and initial alongside their last name.

- Input your Social Security number. If filing jointly, also include your spouse's Social Security number.

- Fill in your present street address, including any apartment number, city or town, state, and zip code.

- Select your filing status by checking the appropriate box—options include 'Single', 'Married filing separately', 'Married filing jointly', or 'Head of household'.

- In Part 1, provide the required tax return information for electronic filing. Enter the total income from the specified lines of Form 1 or Form 1-NR/PY, as applicable. Complete the remaining fields for income tax, Massachusetts use tax, tax withheld, refund amount, and tax due.

- In Part 2, review the declaration statement and provide your signature and the date. If filing jointly, your spouse must also sign and date.

- If you have an Electronic Return Originator (ERO), their signature and information must be filled in Part 3, including the date and their signature.

- If applicable, complete Part 4 by providing the paid preparer's signature and information, also including the date.

- Once you have filled in all necessary fields, save your changes. You can choose to download, print, or share the completed form.

Complete your forms online today for a smoother electronic filing experience.

Make sure you: Sign your tax return. If you're filing a joint return both people must sign the return. Make sure your name, address, and social security number(s) are correct. Check your math. Attach a copy of your federal return (if not using form 540 2EZ) Attach a copy of your W-2. File your original return, not a copy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.