Loading

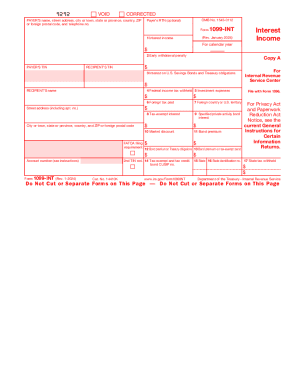

Get Irs 1099-int 2024-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-INT online

This guide provides step-by-step instructions on filling out the IRS 1099-INT form online, which is used to report interest income. Whether you are a seasoned taxpayer or new to this process, this guide aims to simplify the task for you.

Follow the steps to complete the IRS 1099-INT online.

- Click ‘Get Form’ button to obtain the form and open it for completion.

- Fill in the payer’s name and address, including the city, state, and ZIP code, in the designated fields. Optionally, you may provide the payer's routing transit number (RTN).

- Enter the recipient's name and address, including the city, state, and ZIP code, in the appropriate fields. You will also need to include the recipient's taxpayer identification number (TIN).

- Report the total interest income paid to the recipient during the calendar year in Box 1. If applicable, include any early withdrawal penalty in Box 2.

- If there were any interest payments from U.S. savings bonds or Treasury obligations, complete Box 3. Fill in any federal income tax withheld in Box 4.

- Complete the investment expenses in Box 5 and report any foreign taxes paid in Box 6. For tax-exempt interest, fill out Box 8.

- Complete any other applicable boxes such as market discount, bond premium, or state tax information as necessary.

- Once all information has been entered, review for accuracy. Users can then save changes, download, print, or share the completed form.

Start filling out your IRS 1099-INT form online today!

For paper savings bonds The interest will be reported under the name and Social Security Number of the person who cashes the bond or who owns it when it matures. The 1099-INT will include all the interest the bond earned over its lifetime.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.