Loading

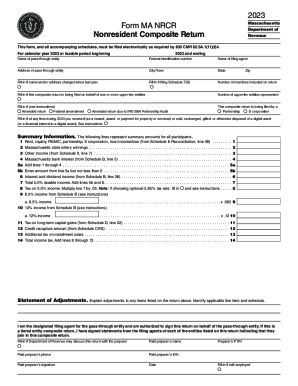

Get Ma Dor Form Ma Nrcr 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA DOR Form MA NRCR online

Filling out the Massachusetts Department of Revenue Form MA NRCR can be a simple process when approached with a clear understanding. This guide will provide comprehensive, step-by-step instructions on how to complete this nonresident composite return online, tailored to meet the needs of all users.

Follow the steps to fill out the form accurately.

- Press the ‘Get Form’ button to access the MA DOR Form MA NRCR and open it in your preferred editor.

- Begin by entering the name of the pass-through entity in the designated field. Additionally, provide the federal identification number to ensure proper identification.

- Fill in the name and address of the filing agent responsible for the submission. Include the city, state, and zip code to complete this section.

- Indicate if there have been any changes to the name or address since the previous year. If applicable, mark this box.

- If you are filing Schedule TDS, specify that in the provided section. This is pertinent for late or inconsistent filings.

- Record the number of members included in this composite return in the appropriate box.

- If filing on behalf of upper-tier entities, indicate the total number of these entities represented by this return.

- If applicable, designate whether the return is amended, if there has been a federal amendment, or if an amended return is due to an IRS BBA partnership audit.

- Specify whether this composite return is being filed by a partnership or an S corporation.

- Complete the Summary Information section by entering values in the lines provided. Start with the total amounts of rent, royalties, and any other taxable incomes as applicable.

- Calculate the total taxable income by entering any additional income, including bank interest and state lottery winnings, and summarize these amounts.

- After entry completion, review all information for accuracy before submission.

- Save your changes, and choose to download, print, or share the completed form as per your requirements.

Start preparing your MA DOR Form MA NRCR online today for a hassle-free tax filing experience.

Related links form

Form 1 or Form 1-NR/PY: Refund: Mass. DOR, PO Box 7000, Boston, MA 02204. Payment: Mass. DOR, PO Box 7003, Boston, MA 02204.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.