Loading

Get Application For Refund Of Tax Paid On Undyed Diesel ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Refund Of Tax Paid On Undyed Diesel online

This guide provides clear, step-by-step instructions for completing the Application For Refund Of Tax Paid On Undyed Diesel. Whether you are new to tax refund applications or seeking a helpful refresher, this guide will assist you in navigating each section of the form effectively.

Follow the steps to complete your application accurately.

- Press the ‘Get Form’ button to obtain the refund application form and open it for editing.

- In the first section, provide your applicant federal employer identification number and, if applicable, your Florida sales tax number. Ensure that this information is correct, as it is essential for processing your application.

- Enter your contact information, including your telephone number with area code, email address, and business partner number, if applicable.

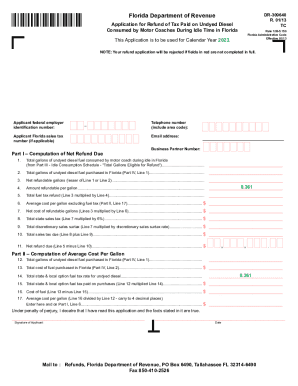

- Navigate to Part I – Computation of Net Refund Due. Start by entering the total gallons of undyed diesel fuel consumed by motor coaches during idle time in Florida, as specified in Schedule III.

- Next, enter the total gallons of undyed diesel fuel purchased in Florida from Schedule IV. These amounts are critical for determining your refund.

- Calculate the net refundable gallons by entering the lesser amount from Line 1 or Line 2 to ensure that your refund claim is valid.

- Input the amount refundable per gallon, which is predetermined by tax regulations, and calculate your total fuel tax refund based on the gallons entered.

- Proceed to calculate the average cost per gallon in Part II. You’ll need to re-enter various amounts including total gallons purchased and total tax paid, following the provided formulas carefully.

- Complete the Schedule of Fuel Consumed During Idle by detailing relevant information for each motor coach, ensuring you measure the fuel consumed accurately using an on-board computer.

- In the Schedule of Undyed Diesel Fuel Purchased, enter all relevant purchase details, ensuring that these are supported by invoices or proper documentation.

- Review each section for completeness and accuracy, paying close attention to any fields marked in red, as failure to complete these may result in rejection of your application.

- Once all sections are filled, you can save changes, download, print, or share the application as needed. Ensure you retain a copy for your records before mailing it to the designated address.

Complete your Application For Refund Of Tax Paid On Undyed Diesel online today to streamline your refund process.

If you paid diesel fuel tax on purchases of diesel fuel and you used the tax-paid fuel for nontaxable purposes, you may obtain a tax refund by filing form CDTFA-770-DU. Do not use this form if you are claiming a tax refund for tax you paid on diesel fuel you used for farming purposes or in an exempt bus operation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.