Loading

Get Fae173 - Application For Extension Of Time To File

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FAE173 - Application For Extension Of Time To File online

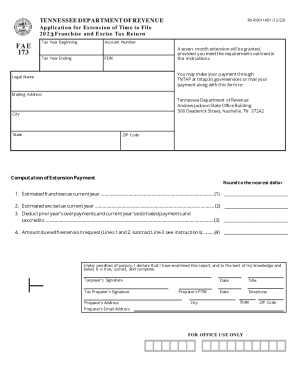

Filling out the FAE173 - Application For Extension Of Time To File is a crucial step for taxpayers seeking a seven-month extension for their franchise and excise tax return. This guide provides clear, step-by-step instructions to help users successfully complete the form online.

Follow the steps to accurately complete your extension application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your account number in the designated field. This number allows the Tennessee Department of Revenue to associate your extension request correctly with your tax account.

- Input the tax year beginning and the tax year ending dates in the provided sections. Ensure these dates match the period you are requesting an extension for.

- Provide your Federal Employer Identification Number (FEIN). This number is essential for identifying your business entity.

- Fill in your legal name, mailing address, city, state, and ZIP code. This information is necessary for correspondence regarding your application.

- Complete the computation of the extension payment by filling out Lines 1 to 4. Estimate your franchise and excise taxes due for the current year, deduct any prior year's overpayments and current year's estimated payments, and calculate the final amount due with your extension request.

- Sign and date the form where indicated. If you have a tax preparer, they should also complete their signature, address, and PTIN.

- Review the completed form for any inaccuracies. Pay close attention to calculations on the payment lines to avoid penalties.

- Once the form is complete, you may save your changes, download, print, or share the form as needed to submit your extension request.

Get started on your FAE173 application online today to ensure your tax extension is handled efficiently.

Related links form

You can register for franchise & excise tax online using the Tennessee Taxpayer Access Point (TNTAP). After your account is established, then complete the Consolidated Net Worth Election application.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.