Get Ar Dfa K-1 2023-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AR DFA K-1 online

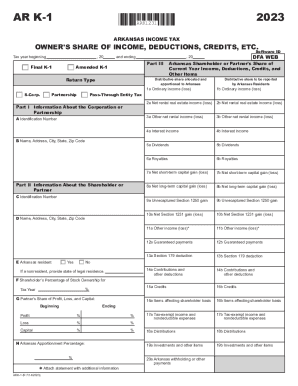

The AR DFA K-1 form is an important document for reporting a partner's share of income, deductions, credits, and other financial items for Arkansas income tax purposes. This guide provides a clear and comprehensive approach to filling out the AR DFA K-1 online, ensuring that you have all the necessary information at your fingertips.

Follow the steps to complete the AR DFA K-1 form accurately.

- Click the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Fill in the tax year information at the top of the form, indicating the beginning and ending dates for the appropriate tax year.

- In Part I, provide information about the corporation or partnership by entering the identification number, name, address, city, state, and zip code.

- Proceed to Part II and input details about the shareholder or partner, including their identification number, name, address, city, state, and zip code.

- Indicate whether the shareholder or partner is a resident by selecting 'Yes' or 'No' accordingly.

- In the areas related to the Arkansas shareholder or partner's share of income, deductions, and credits, accurately report the figures as delineated by the instructions.

- Fill in each relevant section for different types of income and deductions, such as ordinary income loss, net rental real estate income loss, other net income loss, and any special investment income.

- Review all entries for accuracy and completeness to ensure compliance with tax regulations.

- Once all fields are completed and verified, save your changes, and choose to download, print, or share the completed form as needed.

Begin filling out your AR DFA K-1 form online today to ensure your tax reporting is accurate and timely.

Related links form

6.500% The state Use Tax rate is the same as the Sales Tax rate, 6.500%. In addition, you are required to remit the city and/or county tax where the items are first delivered in Arkansas. Sales and Use Tax FAQs Arkansas Department of Finance and Administration (.gov) https://.dfa.arkansas.gov › excise-tax › sales-and-... Arkansas Department of Finance and Administration (.gov) https://.dfa.arkansas.gov › excise-tax › sales-and-...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.