Get Nc-3x Amended Annual Withholding Reconciliation

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC-3X Amended Annual Withholding Reconciliation online

Filling out the NC-3X Amended Annual Withholding Reconciliation form is essential for individuals and businesses needing to correct previously filed withholding tax information. This guide will provide clear, step-by-step instructions to assist users in navigating the online completion of this important document.

Follow the steps to fill out your NC-3X Amended Annual Withholding Reconciliation accurately and efficiently.

- Press the ‘Get Form’ button to acquire the NC-3X Amended Annual Withholding Reconciliation form and display it in the online editor.

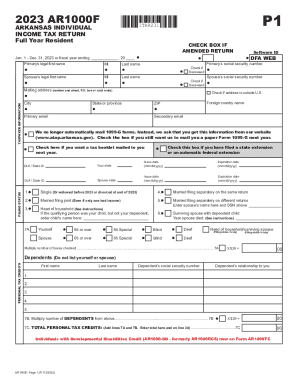

- Locate the section for taxpayer information. Enter your legal first name and last name, along with information regarding your social security number.

- Check the box marked ‘Amended Return’ to indicate that you are correcting a previous filing.

- Provide your mailing address, including the number and street, city, state, and ZIP code. Ensure this information is accurate as it will be used for correspondence.

- Fill in your primary email and secondary email if applicable. This will assist in receiving notifications regarding your submission.

- Indicate your filing status by selecting the appropriate category from the provided options. Carefully assess which options apply to your situation.

- Input any personal tax credits you are claiming. List any dependents if applicable, making sure to include their names and social security numbers.

- Complete the income section by reporting all sources of income. Ensure to double-check the amounts and attach any required supplemental information.

- Calculate your total tax due by adding all relevant lines as directed in the instructions. This includes incorporating any additional credits or adjustments.

- After reviewing your information for accuracy, you can proceed to save your changes. You may then opt to download, print, or share the completed form as necessary.

Begin filling out your NC-3X Amended Annual Withholding Reconciliation online to ensure compliance and accuracy in your tax standings.

Use this form to amend a previously filed Form NC-3, Annual Withholding Reconciliation, if you do not submit the information electronically. If corrections were made to previously filed W-2 or 1099 statement(s) (including Form 1042-S), attach the corrected statement(s) to this form in the designated area.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.